Our services

We provide dispute resolution services according to the Federal Act on Financial Services to clients of financial service providers but also to financial service providersArt. 3 lit. d FAFSF:

Financial service providers are persons who provide financial services on a commercial basis in Switzerland or for clients in Switzerland, with the criterion of a commercial basis being satisfied if there is an independent economic activity pursued on a permanent, for-profit basis. and financial institutions.Art. 2 para 1 and Art. 16 FinIA: Financial institutions within the meaning of this Act are as follows, irrespective of their legal form:

a. portfolio managers (Article 17 paragraph 1);

b. trustees (Article 17 paragraph 2);

c. managers of collective assets (Article 24);

d. fund management companies (Article 32);

e. securities firms (Article 41).

If the law was first conceived to allow clients to dispose of a quick and efficient dispute resolution services, providers and institutions themselves may have an interest to use our mediation and evaluation services.

Dispute resolution

The Federal Act on Financial Services (FAFS) requires that we provide at least mediation services and sometimes evaluation services. We will usually start with a mediation attempt. Our services do not prevent a party from filing claim in court if it decides to sue. The completion of a mediation attempt with one of our Ombudsperson allows such a claimant to bypass the compulsory conciliation attempt (Art. 76 para 2 FAFS).

Mediation

Mediation has become a word of common language. Everyone has its own idea of what it means or what it should mean, few have experienced it. Mediation requires a real intent to negotiate and to talk to each other. It means taking into consideration the parties’ interests and needs. Negotiating with the help of a mediator is not easy, but it can be very rewarding.

We are all experienced mediators and believe that the facilitation of open and good faith discussions by mediation, can be a very efficient way to find solutions. Your Ombudsperson will assist you in the negotiations, using the techniques of mediation. In that part of the process, your Ombudsperson will refrain from taking position on the merits of the dispute.

Mediation is a process in which parties negotiate with the support and assistance of a Ombudsperson. The Ombudsperson has to be at all times impartial and independent from the parties. Our Ombudspersons all undertake to abide by and follow the rules of ethics for mediation promulgated by the Swiss Bar Association.

Independence of the Ombudsperson means that the mediator cannot have any direct or indirect interest in the dispute or any relation with either parties or their representatives the nature and intensity of which may cast doubt as to its impartiality. The Ombudsperson’s independence also means that the Ombudsperson can terminate the mediation when it believes in its own opinion that the mediation is not leading to solutions or any of the parties’ interests, attitude or behaviour is not compatible with the mediation.

Impartiality means that the Ombudsperson should not express any preference towards one of the parties or the positions expressed by one of the parties.

Evaluation

Evaluation is when the Ombudsperson takes position on the merits of a claim or a defence, explaining weaknesses or strength of a claim or a defence. To many who practice mediation, evaluation is an oxymoron. To the many more who do not practice mediation, evaluation by the mediator seems a logical thing to do in certain circumstances. The Federal Act on Financial Services opted for evaluation (Art. 75 para 8 FAFS) in disputes between a client and a Financial service provider.

The FAFS grants the Ombudsperson various powers, to lead the proceedings, to request information from the financial service provider, to assess the case, to issue an evaluation. The legal expectation is that the process settles the dispute, unless this is not possible.

With a view to contribute to the resolution of financial differences between clients and Financial service providers, the FAFS imposes certain duties on the Financial service providers. First, they have to inform their clients about the possibility to resolve disputes by mediation through an Ombudsperson (Art. 79 para 1 FAFS). In case a client requires such mediation, the Financial service provider must participate to the proceedings (Art. 78 para 1 FAFS). Financial service providers must also respond promptly to summons, requests for comments and information coming from the Ombudsperson (Art. 78 para 2 FAFS).

In the end, the Ombudsperson may issue a written evaluation of the merits of the dispute, which means about the facts and the law. That evaluation is not subject to the same confidentiality obligation as the rest of the proceedings as it is provided with a notification of the closing of the proceedings. The more the Ombudsperson knows about the case, the more precise will be the evaluation.

Still, the Ombudsperson may lead the proceedings as it deems appropriate. The Ombudsperson may have confidential meetings or exchanges with one party only.

Confidentiality

To be able to negotiate openly and in good faith requires that parties be protected. This is the role and function of confidentiality. The statements you make, the positions taken, the admissions are to remain confidential and cannot be referred to by the parties in subsequent or parallel proceedings.

Our Rules of procedure contain detailed provisions on confidentiality.

The filing of a Request for Mediation, its contents, the name of the parties and the dispute at stake, are confidential.

Confidentiality matters but is not absolute. The dispute at stake, the set of facts underlying a dispute, cannot themselves become confidential. Same with existing evidence. That would be contrary to the fundamental right of parties to seek redress in court. What is confidential is what the parties express during the mediation process, such as settlement offers, statements made, reactions and declarations in answer to proposals or allegations, admissions made during the mediation. All these elements are subject to a confidentiality obligation and cannot be revealed outside of the mediation and in particular cannot be referred to in subsequent proceedings.

A specific aspect of confidentiality, takes place when your Ombudsperson communicates with one party only. Unless released from its confidentiality obligation by the disclosing party, the Ombudsperson should not reveal these facts to the other party.

Now, in all mediations taking place within the scope of the Federal Act on Financial Services, the ability of the Ombudsperson to issue an evaluation is a challenge to confidentiality. If a written evaluation is issued, it is not confidential. Elements that have been disclosed in confidence by one party to the Ombudsperson cannot be mentioned in the said evaluation.

These are questions that can be discussed with your Ombudsperson.

For more, see article 14 of our Rules of procedure.

Costs

The main costs to be incurred as part of a dispute resolution procedure are the fees of the Ombudsperson on the one hand and the one-time registration fee. The one-time registration fee is to be paid at the time of the filing of the Mediation Request Form, by the requesting party. As required by the Federal Act on Financial Services and in mediations falling within the purview of the FAFS, all fees of the Ombudsperson and advances or deposits requested by the Ombudsperson are to be paid by the Financial service providers involved. In relation to all other mediations the Ombudsperson’s fees are shared equally between the parties.

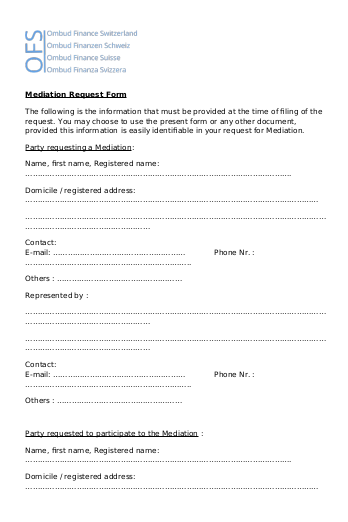

Filing a mediation request

To file a request for a mediation regarding a dispute over financial services, you may use the Mediation Request Form. That form contains the information that must be provided at the time of filing of the request. If you choose not to use the present form kindly make sure that this information is easily identifiable in your request for Mediation.

Your request must contain a brief description of the main relevant facts and your legal arguments. Preferably, all exhibits relevant to your description have to be filed with the request, following the numbering C-1, C-2, etc.

Intentionally and for confidentiality purposes, we have decided not to set up an online filing system. Any suggestion in that respect is always welcome, to be sent at contact@ombudfinance.ch